There’s a view on technology transfer as a two-way exchange. In the ‘technology push’ mode, academics do great research, technology transfer offices (TTOs) protect the discoveries that are unique and have value, then find companies to license or co-develop them. Going the other way is the ‘tech transfer market pull’. Companies in industry will define technical problems, look for academic experts and inventions to solve them, then bring them in-house to commercialise.

This ‘tech transfer market pull’ was the focus of a conversation we hosted in New Orleans at AUTM 2022 with speakers from industry and academia – Bruce Bloom from HealX, Pooja Bhayani from UCLA, and Prabhpreet Gill from Princeton University – about how feedback and metrics of industry engagement are being used by TTOs to make more informed decisions and drive success.

What does a ‘tech transfer market pull’ look like?

The first question we asked our panel in New Orleans was ‘how do you (TTOs) record and measure feedback and engagement metrics, and how do you (companies) share your requirements and feedback?’

From Bruce, the Chief Collaboration Officer at HealX, we heard about how his team start by building an extremely detailed picture of the landscape within which they can identify the need for technical solutions and expertise from academia – a picture that includes customer needs, economic models, pathways to the market, as well as scientific fit and desired biological action. They then communicate their requirements through established academic networks and scouting platforms such as Discover.

After receiving the submission of a potential solution from an academic or TTO, HealX can usually make a decision within an hour about whether a project is within scope. But for projects that do have a potential fit, the following triage can take weeks to months depending on what data is available and if further testing is required. Bruce and his team then take a generous approach to sharing their evaluation, always providing feedback on projects selected for further assessment.

From Pooja, a Business Development Associate, and Gill, a Technology Licensing Associate, we heard about the different ways that feedback is provided to their TTOs by industry and how they distribute it internally. It usually comes through email, at conferences, over the phone or on video calls, as well as through some technology marketing platforms. In addition to feedback provided when a company reviews an asset, Pooja and Gill spoke about how feedback also comes in the shape of data analytics and engagement metrics that measure interest across their portfolios.

How can a tech transfer ‘market pull’ be leveraged?

The second question we asked our panel in New Orleans was ‘what are the benefits of industry feedback and engagement metrics, and how can they be used to inform decisions in technology transfer?’

From the tech transfer perspective, we heard from Pooja and Gill about a number of ways that a market pull from industry has helped their teams to inform decisions and generate success, including:

- Providing evidence to inform decisions on patenting, particularly in the provisional patent stage, and where to prioritise protection based on geographical interest.

- Helping to define specific applications for a technology with broad impact.

- Using the feedback to open a conversation with the company about other relevant research or as-yet-undisclosed datasets.

- Increasing engagement with academics by showing them a clear demand for their expertise.

- Increasing the profile and reputation of the TTO and researchers to ensure the company returns.

From Bruce, we heard about cases in which his feedback has led to academics going away to generate more data before HealX picks it up for a more thorough evaluation. And in other cases, where a project has shown real potential, HealX has set up an option agreement to support further research before starting a more embedded partnership.

A point Bruce made worth underlining was about the need to ask for feedback. He recommended that TTOs pose questions about how they think the technology can be best implemented, and to communicate any uncertainties or openness to adaptation. This approach is a way to steer the conversation, ensuring the industry partner fully understands the invention and surrounding expertise and gathering valuable feedback to inform decisions about the future of the patent/project.

Wrapping up the conversation

The take-home I left with from the session was about the need to meet in the middle. Tech transfer is about asking the right questions, a collaboration in defining the commercialisation of an academic invention with each party nudging it along based on their requirements and insight, rather than a purely transactional exchange. If technology push is about finding a gap in industry with the same shape as the research, market pull is about finding a gravitational attraction centred on an industrial need.

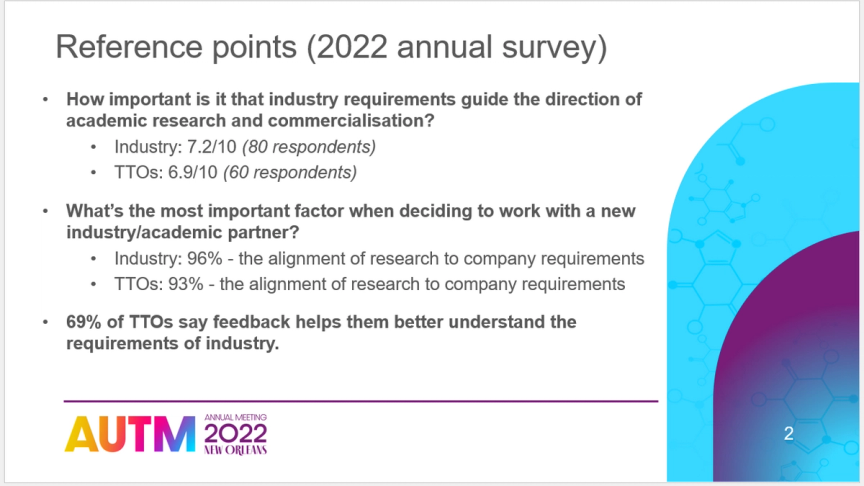

For context, our experience matching academia with industry is why we look at tech transfer through this frame. With our matchmaking platform, Connect, 40% of the 12,000 conversations we’ve started since 2014 began as feedback from a company about a research project or technology. Through our scouting offering, Inpart Connect Campaigns, we ran 55 campaigns in 2021 on behalf of companies looking for solutions to technical requirements, receiving an average of 60 submissions per campaign from a total of 531 universities across 45 countries. And more recently in our 2022 annual surveys, we also got clear signals about the demand for a market pull from industry.

Inpart 2022 survey findings presented at the annual AUTM conference.